What Class does your condo fall under?

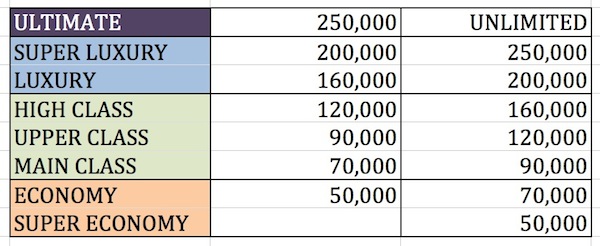

Surprisingly, few people know that Thailand has a comprehensive classification system for grading the class of a condominium based on the market price per square meter.

Thankfully this grading system has managed to remove any personal preferences or biases from the equation. Whereas the market price per square meter is a proven indicator of market sentiment towards any particular location, building and unit and as such this system has been used extensively in Bangkok.

Figures are based on Per/Square Meter ThinkOfLiving.com

The fact that Pattaya has experienced an unprecedented growth surge in recent years both in terms of pricing and the sheer number of units is undeniable.

However unlike Bangkok where the vast majority of purchased condominiums are still intended to be used for primary use as personal abodes, Pattaya is still ostensively a resort town and secondary/holiday home market and as such is priced accordingly.

This explains why Pattaya has yet to feature a condominium in the ‘Super Luxury’ or ‘Ultimate’ class category, however given time, I’m extremely confident that this will happen in the foreseeable future. In the absence of the before-mentioned class categories in the Pattaya market and for the sake of clarity, I will only be covering the ‘High Class’ , ‘Upper Class’, Main or Middle Class’ and ‘Economy & Super-Economy’ classification segments in this article.

A common mistake, particularly amongst foreigners and more especially the ones that have a very rudimentary understanding of pricing relative to their own home countries is that they often have unrealistic expectations. This mismatch of expectations relative to pricing can be further compounded by them mistakingly comparing their condominium to that of a condominium in an altogether different class category. Rest assured with the help of the above class classification system you’ll be taking a step in the right direction.

High-Class Segmentation (120,000THB to 160,000THB Per Square Meter)

These developments tend to be dominated by the Bangkok based developers such as ‘Raimon Land’ & ‘Sansari’ with a few noticeable exceptions such as ‘The Palm’, by Nova Group. These projects tend to be high-end, high-rise developments with direct beach access in upmarket locations such as Wong Amat or Na-Jomtien. Projects such as ‘Northpoint’, ‘The Zire’ and ‘Movenpick White Sands Beach’ safely fit into this category. However the lack of direct beach access does not necessarily exclude a condominium building from this category as aptly illustrated by ‘Northshore’, which is located in central Pattaya.

Perhaps the key determinate is the perceived exclusivity of the building, which is very often the sum total of the buildings architectural design, communal amenities, quality of the fixtures and fittings within the individual units themselves and lastly the desirability of the location.

Upper Class Segmentation (90,000THB to 120,000THB)

These developments tend to have all the hallmarks of a ‘Higher Class’ segment condominium apart from the location and the quality of the fixtures and fittings within the individual units themselves, which tends to be slightly inferior to that of its higher class counterparts.

Once again Bangkok based developers such as ‘Raimon Land’, ‘Sansari’ and ‘S.C. Asset Management’ feature heavily in class categorisation sector. Furthermore it’s not inconceivable for a unit in this class category to exceed 120,000THB per square meter if its on an extremely high floor. Nonetheless apart from the exception of a slightly enhanced view due to relative floor height, the fundamentals of the buildings location and the quality of the fixtures and fittings continues to remain unchanged irrespective of price. There is a direct correlation between developers pricing and floor height so please be careful not to confuse the 2 class categories.

Projects such as ‘Riviera Wong Amat’, ‘Riviera Jomtien’ and to a slightly lessor extent ‘The Base’ and ‘Centric C’ typically fall within this class category. Units in this category tend to be in modern high-rise developments in prime central or near beach locations with a heavy emphasis on upmarket communal amenities and sea-views.

Main Class Segmentation (70,000THB to 90,000THB)

This sector is favoured by the average Joe whose looking for the optimum bang for his buck. This market sector tends to be dominated by both smaller and locally based developers such as ‘Nova Group’ and ‘Tulip Group’. Projects such as ‘Centara Avenue Residences and Suites’ and ‘Golden Tulip Residence and Suites‘ typically fall within this class category. Units in this class category tend to be in low-rise developments in prime inner-city locations. The units within this class category tend to have better quality fixtures and fittings than their ‘Upper Class’ counterparts in a bid to make up for a lack of sea-views and a lessor location. Developers in this class category typically substitute pool views for sea views and heavy emphasis is placed on the communal amenities, which are often comparable to their ‘Upper-Class’ counterparts.

Perhaps the core underlying appeal of this class category at least from the perspective of the average Joe is that a unit within this class category is often a considerable upgrade to what he’s either accustomed too or can otherwise afford back home in his own home country.

Economy Class Segmentation (50,000THB to 70,000THB)

Again this sector tends to be dominated by the smaller and more locally based developers such as ‘Nova Group’, ‘Blue Sky Group’, ‘Global Top Group’ and ‘Matrix’. Projects such as ‘City Garden Pratumnak’, ‘Atlantis’ and ‘Art on the Hill’ typically fall within this class category. Units in this particular class category tend to be low-rise developments on the outskirts of Pattaya. Prospective buyers in this particular class category are looking for added value for money, plain and simple. They also tend to be frequent visitors to Pattaya with access to their own personal transportation, such as a motorbike.

In return for making major concessions on location i.e. somewhere on the outskirts of Pattaya and to a lessor extent on both the quality of the fixtures & fittings and communal amenities one’s able to buy a larger unit……it’s really that simple.

Super Economy Class Segmentation (Below 50,000THB)

The typical consumer in this particular class category is highly budget orientated and pricing takes precedence above all else. As a result major concessions have to be made on both the location, quality of fixtures and fittings and the amenities themselves. In an effort to keep costs down to a bare minimum these units are typically mass produced and projects with a unit count in excess of 1,600 units are now the norm. These units are also typically furnished with cheap mass produced furnishings from China.

Given the sheer amount of units which are all virtually identical to one another its an almost impossible task to differentiate one unit from another on any other basis apart from price, which doesn’t bode well for the future especially when it comes to reselling the unit. Thus it shouldn’t come as any surprise that these units seldom appreciate in value.

Budget orientated buyers would consider buying into an older building as opposed to a new build on the proviso that the build quality is superior and/or if the location is somewhat better. In a nutshell you get what you pay for and I strongly advise you to exercise extreme caution when considering buying a unit in this class category.