Free Legal Advice

My Pattaya Condo recommends that our existing clients take advantage of our generous offer of a free initial legal consultation with an independent fully qualified Thai Lawyer who has extensive legal experience in property related matters. Once the free initial consultation has been concluded should you decide to use the Thai Lawyers legal services commercial rates will then apply. However it never hurts to have a Thai Lawyer on your side to oversee the entire process from start to finish in order to ensure that your interest’s are completely safeguarded.

My Pattaya Condo recommends that our existing clients take advantage of our generous offer of a free initial legal consultation with an independent fully qualified Thai Lawyer who has extensive legal experience in property related matters. Once the free initial consultation has been concluded should you decide to use the Thai Lawyers legal services commercial rates will then apply. However it never hurts to have a Thai Lawyer on your side to oversee the entire process from start to finish in order to ensure that your interest’s are completely safeguarded.

Indeed, when buying a condominium, or any property in Thailand, it is absolutely essential to obtain accurate and up-to-date information and legal advice as to the best way to proceed, in order to safeguard and secure your monies and assets.

Legal services concerning the purchase of property may include the following and which are explained in more detail in the legal section below:

- Due Diligence and investigation of a potential property to ensure it is safe to buy before paying even deposits on a property.

- Sale and Purchase of property contracts.

- Transfer of the property at the local Land Office to your name or a Thai individual or company.

- Setting up a Thai Limited Company for the purposes of owning a property.

- Leases and other land owning rights such as usufructs and habitation contracts.

- Preparation of a Thai Will to ensure that your assets are protected and are passed onto your loved ones on your demise.

- Foreign Transaction Letter.

For your convenience, you can simply play audio instead of reading.

When buying a condominium or indeed any property in Thailand, it is generally prudent to conduct an investigation into the proposed property to be purchased in order to identify exactly what you are investing in and that it is safe to proceed. The Service could involve a lawyer carrying out any or all of the following:

- A check of the title deed (Chanote) of the property to be purchased, to identify who the real owner of the land and/or property. This could be different the person who is offering the property for sale.

- If the condominium or other property is still being developed and is currently under construction, then a title deed will not have been issued yet by the local Land Office and so it is essential that a lawyer checks the credentials of the Developer or Company developing or building the property. This will involve checking that they own the land in question or that they have an option/contract to buy the land on completion of the Project.

- If a Purchaser is buying a Property ‘off-plan’ and it is still under construction, it is important that a lawyer checks that the Developer has all the required permits to commence the work and indeed complete the construction, such as a Building Permit and has also obtained an Environmental Impact Assessment (EIA), if applicable. This will involve a lawyer checking at the local authority department to ensure that all the regulations have been complied with and that all relevant permits have been legally issued. For example, on many occasions, Purchasers have failed to make these checks and later discovered that the Developer has not obtained the various permits and ultimately will not be able to transfer the property to the Purchaser on completion of the Project.

- It is sometimes wise for a physical inspection to be carried out on the property to check whether it has already been built or is still under construction, or merely still on paper. This will also identify whether the property has been built to a good standard and is connected to public roads and that a Purchaser will have right of way and access to their proposed property purchase. This may involve checking the title deeds of adjoining properties and the ‘freeholder’ or Developer of the land to ensure that the relevant rights, easements and benefits have been transferred to the proposed purchase property and whether there are any other encumbrances on the property that the Purchaser needs to be aware.

- With large off-plan Condominium Developments, the Developer must initially apply for an Initial Environmental Examination (IEE) report which is filed with the provincial Office of Natural Resources and Environment. Your lawyer can check that this has been properly filed and approval has been granted. All too often a Developer changes their construction plans after the IEE has been granted and then later is unable to complete the Project as the permits are then invalid. A lawyer will check that the initial approved plans reflect the current reality of the Project.

- Your lawyer can also check whether the condominium development has the legally required parking spaces for such a development to be completed.

- It is often the case, particularly with less well-known Developers, that Company checks should be carried out to ascertain whether they are solvent and have adequate financial backing for completion of the Project, other than raising funds purely through pre-sales. A lawyer may also check whether the Developer Company has any litigated court cases against them, either current or historical and which may affect whether the potential Purchaser is at risk by contracting to purchase a property

- If a Sales and Purchase Agreement is presented to you by a Developer, which is often the case, then your Lawyer can check that the contract is fair and in your favour. There may be clauses that do not allow you to cancel the contract under certain circumstances or omissions and especially with the sale of off-plan condos which do not give you a fair rent if the Development is seriously delayed in its completion. There are often clauses in Developer’s Sales and Purchase Contracts which also are contrary to the law, such as that the Purchaser pays 50% of all taxes at the Land Office on completion. Legal advice under the Due Diligence Service will identify these issues and suggest alternatives, so that as a Purchaser, you get a fair deal before signing the Contract. Any amendments to the contract will be suggested by the lawyer and presented to the Seller for inclusion in their often so-called “standard contract”.

- After carrying out all these checks and investigations, your lawyer will provide a report detailing the issues, if any, giving you the green light or otherwise and making suggestions as how to rectify any problems. The report will give you peace of mind as to whether you are making a sound investment and spending your money wisely or whether the proposed purchase should be avoided altogether.

When buying a condominium, which is often off-plan, the Developer will usually present the potential buyer with a sales and purchase agreement or contract. This is checked by the lawyer to ensure that the terms and conditions are fair and favourable for you and this is carried out as part of the due diligence service, as explained in that section of this website.

However, sometimes, particularly with already built condos, second-hand condos or other properties and land, it is often up to the buyer to present a Sales and Purchase Agreement to the seller for checking and signing. This is where a lawyer can help in drafting such as contract for you, the potential buyer. The process will involve investigating the parties that need to be included in the contract which will necessarily require a check of the title deed of the property to be transferred to ensure that the purported seller of the property is the same as that on the title deed.

This service will involve a lawyer representing you at the relevant land office when the time comes to transfer your purchased property into your name, or nominated Thai individual or Thai company. Your lawyer will ensure that the correct monies have been paid to the seller and calculate the land office transfer fees and taxes that have to be paid on the day of the transfer. If you are not able to be present at the time of transfer, a lawyer will arrange that you have signed a Power of Attorney (POA) for the lawyer to act on your behalf in transferring the property.

Taxes and Transfer Fees payable at the land office are generally broken down as follows:

With off-plan condominium purchases the buyer is only responsible for paying 50% (half) of the land office transfer fees which are 2% of the land office appraised valuation of the property. The valuation is generally less than that amount which is actually paid and is based on the valuation of the property when it was last transferred at the land office. However, with new condos, the valuation is that as disclosed by the Developer.

Other transfer taxes are the responsibility of the Seller and include ‘withholding (income) tax at 1% and ‘specific business tax’ (SBT), which is payable if the property is sold within 5 years of the last transfer and levied at 3.3% of the land office appraised value. If not applicable then a 0.5% stamp duty tax is payable.

The withholding or income tax is levied depending on whether the seller is an individual or a company. If the seller is a company the tax is 1% of the sales price or assessed value, whichever is higher. If the seller is an individual then the income tax is calculated on a progressive income tax scale.

As many buyers will know, foreigners cannot legally purchase land in their own name in Thailand unless they invest a minimum of $1 Million USD under Thailands Board of Investment (BOI) scheme, however for most foreigners this simply is not possible as they don’t have sufficient finances to qualify. Fortunately the Thai Government does offer foreigners with a viable alternative in the form of a condominium in foreign quota, as long as total no. of condominiums under foreign quota does not exceed 49% of any particular condominium development.

In the case of a foreigner who wants to buy a single dwelling on a piece of land, such as a house or townhouse etc., or a condominium in Thai quota, which forms no less than 51% of any particular condominium development, then a foreigner must either transfer the property into a Thai individual name or set up a Thai Limited Company to own the property.

Setting up a Thai limited company for the purposes of owning a property is fairly straight-forward and requires a visit to the Department of Business Development (DBD) which the buyer’s lawyer will carry out as part of the service. A Thai limited company must have a minimum of 3 shareholders, of which 51% of them must be a Thai citizen or another Thai company. A foreigner is allowed to own 49% of the shares of the company.

The usual structure for buyers setting up a company for the purposes of owning land is that the foreigner takes 49% of the shares and then divides the 51% of the shares between their 2 nominated Thai shareholders in whatever proportion they wish. For example 26% and 25% or 48% and 3%. The foreigner can then also ultimately be the sole Director of the company. In practice, on the initial transfer of the property into a Thai limited company at the land office, the company structure must show a Thai shareholding of 100%. The 49% of the foreigners’ ultimate shareholding is often held by one of the lawyer’s staff temporarily until the land is transferred into the company and then changed immediately afterwards to the foreigner at the DBD.

The company valuation and the value of the shareholding depends of the value of the property. Such that, if a property is valued by the land office at 2 million Thai baht then a company with a share valuation of 2 million Thai baht must be registered.

The normal cost for setting up a Thai limited company with a share capital of 1 million Thai baht is THB 35,000 and the costs increase by THB 10,000 for every 1 million Thai baht of share capital.

As explained in the section on setting up a Thai limited company, foreigners cannot generally own property in Thailand. Aside from setting up a Thai limited company, however, there are other options for foreign buyers of properties to consider.

These include registering a lease for 30 years on the property to be purchased, with the freehold remaining in the name of a Thai individual or Thai company. It is also possible to extend that lease for a further 30 years or even 60 years, but this is in no way automatic and a renewal must be sought during the final few years of the original lease. A clause in the original lease can be provided to indicate the parties’ intentions to seek a renewal when the time comes.

Your lawyer can draw up a lease agreement between the lessor (seller) and the lessee (buyer) comprising of the terms and conditions similar to when buying a ‘freehold’ condominium. This lease can then be registered at the land office with the lessee’ name being noted on the title deed (Chanute). Registration of the lease, as it is over 3 years, will also attract fees and taxes at the land office, which are assessed on the ‘rent’ of the land and property over the lease term, which is 1.1% of the rental value over the lease term.

A 30 year lease will provide protection for the foreigner in that the lessor or freeholder cannot sell the land from under them, as any sale will require the consent of the lessee.

If you are buying or leasing land for the purpose of constructing or building a structure on it, it is essential to make sure that you are allowed to build such a structure or house on the land. This is sometimes called the “right to Superficies“. The foreigner can apply for a construction permit in their own name and they will own the structure in their own name. As such, at the end of the lease term, in theory, the foreigner can then demolish the house and return the land to its original condition or come to an agreement to sell the structure to the lessor or freeholder.

Leases are also valid even upon the demise of the lessor, or in the event that the land is sold. However, leases are only transferable to third parties in the event that the lessor of the lease permits it.

Another land and property right is a ‘Usufruct’ which provides for temporary ownership over the land to include use of, enjoyment and profits gained over the land, as long as the land is not damaged or altered and is returned to the freeholder at the end of the term. The term is similar to a lease, which can be up to 30 years, but may also be for the life of the ‘usufructuary’, (defined as the person who enters into an agreement with the freeholder of the land). As with a lease, this right can be registered with the relevant land office and the usufructuary will be noted on the title deed as having a right to occupy and receive the benefit of that land for the agreed term or life of the usufructuary. However, this right is often at the discretion of the land office and may vary from time to time, due to no taxes being payable and only a nominal registration fee.

As with the lease, the foreigner gains a protected servitude which cannot be extinguished, nor the land sold, without the consent of the usufructuary. The usufruct is a personal right however and cannot be inherited, expiring on the death of the usufructuary. However, a usufruct can be transferred to a third party during the term or life of the usufructuary under the Thai Civil and Commercial Code, though any damages, if applicable, in law can still be claimed by the grantor of the usufruct against the original usufructuary.

One feature of a usufruct is that the original usufructuary can enter into a 30-year lease with a third party (perhaps a family member) and if the usufructuary dies during the term of the lease, the lessee (tenant) can still retain the rights of the 30 year lease until its expiration, despite the usufruct having expired.

Other land rights, such as Habitation Agreements are also possible, allowing the ‘grantee’

It is strongly recommended that an owner of property in Thailand have a Last Will & Testament prepared in both your home country and in Thailand to include your newly purchased property. This is so that your beneficiaries can easily obtain control of your assets without the further problems of dying intestate (without a Will) and your beneficiaries having the added stress of proving their entitlement at court and your assets being distributed according to the Thai statutory list of relations (which is different to many other countries and may not be to your own choice).

In general, the testamentary priorities in Thailand are that the spouse, if any, will receive half of the value of a testator’s estate (Sin Somros), with the remainder being distributed in order of priority of children first and followed by parents, if none exist of the first category. The priority list then follows to brothers and sisters, grandparents and then to aunts and uncles. If there are no living relatives at your demise then the assets devolve to the Thai State.

The last Will and Testament should detail your assets in Thailand, such as property, shares in a Thai company, bank accounts, vehicles, and personal items. Typically upon the death of a foreigner in Thailand, the government officer or usually court judge, will ask the family of the deceased for a copy of a Will or they will seek the deceased person’s lawyer or executor for this document. Having a Will drafted in your home country to cover assets in Thailand may be problematic and burdensome to your family as documentation will need to be translated, notarized and approved by a government body.

Purchasing a property in Thailand is a relatively smooth and straight forward process, however, there are a few simple things that you must first bear in mind before buying a property here in the land of smiles.

In order to prevent money laundering, the Thai authorities require you to get a “Foreign Currency Transaction Letter” from a Thai banking institution by following these simple and easy steps:

- You must send the funds in your own foreign currency, i.e. US Dollars, Euro’s, etc., from overseas. Please avoid the common mistake of first converting your foreign home currency into Thai Baht, and then sending the money to Thailand from your overseas bank as you will not be eligible for a “Foreign Currency Transaction Letter”. The funds must arrive in Thailand in a foreign currency and the receiving Thai bank will then convert the money into Thai Baht on arrival.

- There must be a clear path from Bank A in your own home country to Bank B in Thailand so the authorities can track your money. Also, the origin of the funds must be tracked back to Bank A, which must be in your name. Please avoid the use of third party intermediaries in a bid to get a better exchange rate as this complicates the smooth tracking of the funds from Bank A to Bank B, which will result in delays, and in some cases, prevent you from being eligible for a “Foreign Currency Transaction Letter” from a Thai banking institution.

- When transferring the funds from Bank A in your own home country, please specify that the reason/purpose for the overseas transfer is to “Purchase a Condominium/Property in Thailand”.

- Now for your Bank B options, normally you will be sending the funds to either a Developers or Real Estate Agents bank account in Thailand, and in this case, the Developer or the Real Estate Agent will request a copy of the “Foreign Currency Transaction Letter” from their Thai bank for you. Yet another option if you already have a Thai savings account is to send the money from Bank A overseas to your Thai savings account in Bank B. In this case, you must be to present in Thailand at the time as your Thai bank will require you to lodge the request for a copy of the “Foreign Currency Transaction Letter” in person.

Do not bring large amounts of foreign currency on your person or in your baggage when flying into or out of Thailand for the following reasons:

- Safety reasons, money can easily be lost or stolen.

- Customs reasons, the Thai customs allows you to bring in a maximum of USD $10,000 (or equivalent) when flying into Thailand without the need to make a formal declaration. If the Thai customs authorities catch you bringing in more than USD $10,000 (or equivalent), and you’ve failed to declare this on your arrivals card beforehand, you will be suspected of money laundering and the Thai authorities can confiscate the money on the spot, and worse still criminally prosecute you or ban you from entry into Thailand. So please avoid doing this at all costs.

So how does having a “Foreign Currency Transaction Letter” help me?

- For starters, if you purchase a condominium under “Foreign Quota” you can register title under your own name on the title deed over at the land office.

- If you work in Thailand and have a valid work permit, you will only be taxed on locally-sourced income as you have ample proof that the funds used to purchase a Thai property were sourced from overseas.

- Should you ever resell the Thai property, you can easily repatriate the funds back overseas.

Please note, that there is a common misconception out there amongst foreigners that owning a “Thai” property automatically guarantees you a Visa – I can assure you with 100% certainty that this is not the case. Instead, one has to apply for a Visa based on your own individual merits i.e. age, financial or marital status, and/or employment status, etc.

Fortunately for us, eligible foreigners can avail themselves to a number of Visa options depending on their desired length of stay. And as such, we at My Pattaya Condo welcome the opportunity to refer you onto a qualified and fully independent Visa specialist, for an “initial free consultation” and thereafter commercial rates shall apply.

I cannot over stress the importance of having both a valid Thai Visa, and perhaps more importantly being cognizant of the expiry date of your existing Visa to avoid any overstay as the Thai authorities take these matters very seriously. In a nutshell………if you contravene the Law, you will be subject to either a fine (depending on the length of overstay i.e. the number of days that you’ve overstayed) at best or at worst face both a fine and arrest, whereupon you’ll find yourself being forcibly deported from Thailand, and even worse still find yourself being banned from re-entering Thailand for many years to come…….so please take this matter very seriously.

Short-term Visa Options (30 to 90 Days)

Starting with the basic “Tourist Visa on Arrival” a foreigner can stay in Thailand for a maximum of 30 to 60-Days, whereas this should not be confused with that of a “Double Entry Tourist Visa”, which allows a tourist to stay in Thailand for up to 90 Days. However, unlike the “Tourist Visa on Arrival” which is granted to most tourists from recognized “friendly nations” with similar reciprocal arrangements in place, a “Double Entry Tourist Visa” is not granted on “arrival”. Instead one needs to first apply for this visa (logically at the nearest) Thai Embassy or Consulate in your own home country before coming to Thailand. And assuming that your application is successful, you’ll be allowed to stay in Thailand for up to 60 Days for “tourism” purposes only as opposed to just 30 Days with the before-mentioned “Tourist Visa on Arrival”, hence the reason why it’s often referred to as a “Double Entry” (i.e. twice the time) Visa, which can be extended for a further 30 Days, by virtue of applying for an “extension of stay” over at the nearest Thai Immigration Department.

Medium-term Visa Options (365 Days)

If you wish to stay in Thailand for 91 Days or more, it’s recommended that you apply for one of the following Thai “Non-Immigrant” Visas:

- Retirement Visa: You must be 50 Years old or more, and prove that you have sufficient “financial means” i.e. have 800,000THB or more, in savings in a Thai bank account, or income such as a pension, dividends, or rental income from overseas properties, etc. to be eligible for this Visa.

- Educational Visa: You must study a subject such as the “Thai” language for instance, which is on the pre-approved list of course material and attend a recognized school, college, and/or university. Furthermore, you must actively attend a large majority of your lessons, and consistently pass all of your course material to remain eligible for this Visa. This Visa, is heavily scrutinized by the Thai Immigration Authorities as it was open to widespread abuse in the past with people attending bogus schools, and doing bogus courses with very little to show in terms of attendance and academic results.

- Business Visa: You must either own your own Thai Business, or be employed by a Thai Business in a pre-approved occupation, and be in possession of a valid “Thai Work Permit” to be eligible for this Visa.

- Family/Spousal Visa: You must either be legally married to a Thai national and/or have “Thai” dependents i.e. children, and can prove that you have sufficient “financial means” i.e. have 400,000THB or more, in savings in a Thai bank account, or income such as a salary or pension, etc. to be eligible for this Visa.

Apart from the notable exception of an Educational Visa, there is no official limit as to the number of times that a “Non-Immigrant” Visa can be renewed over the subsequent years, and this process is by no means automatic and is instead very much dependent on individual merits of the applicant at the time of reapplying, and there is “no time gap” between the expiry date of the “old” Visa and the issuance date of the “new” Visa.

Also, if you’re planning to travel abroad please make sure that you get a “single or multiple entry” permit from the Thai Immigration Department before you travel overseas or you will automatically lose your “Non-Immigrant” Visa on your return and be issued with a “Tourist Visa on Arrival” instead…..so please bare this in mind.

Long Term “Thailand Privilege” Visa Options (5, 10 & 15 Years)

Long Term “Thailand Privilege” Visa Options (5, 10 & 15 Years)

“Thailand Privilege Card” membership is open to singles and/or family members for either 5, 10 or even 15 years, with a choice of no less than 3 different membership options, each of which come with varying terms and conditions, rates, and permissible durations of stay for you and your family to choose from.

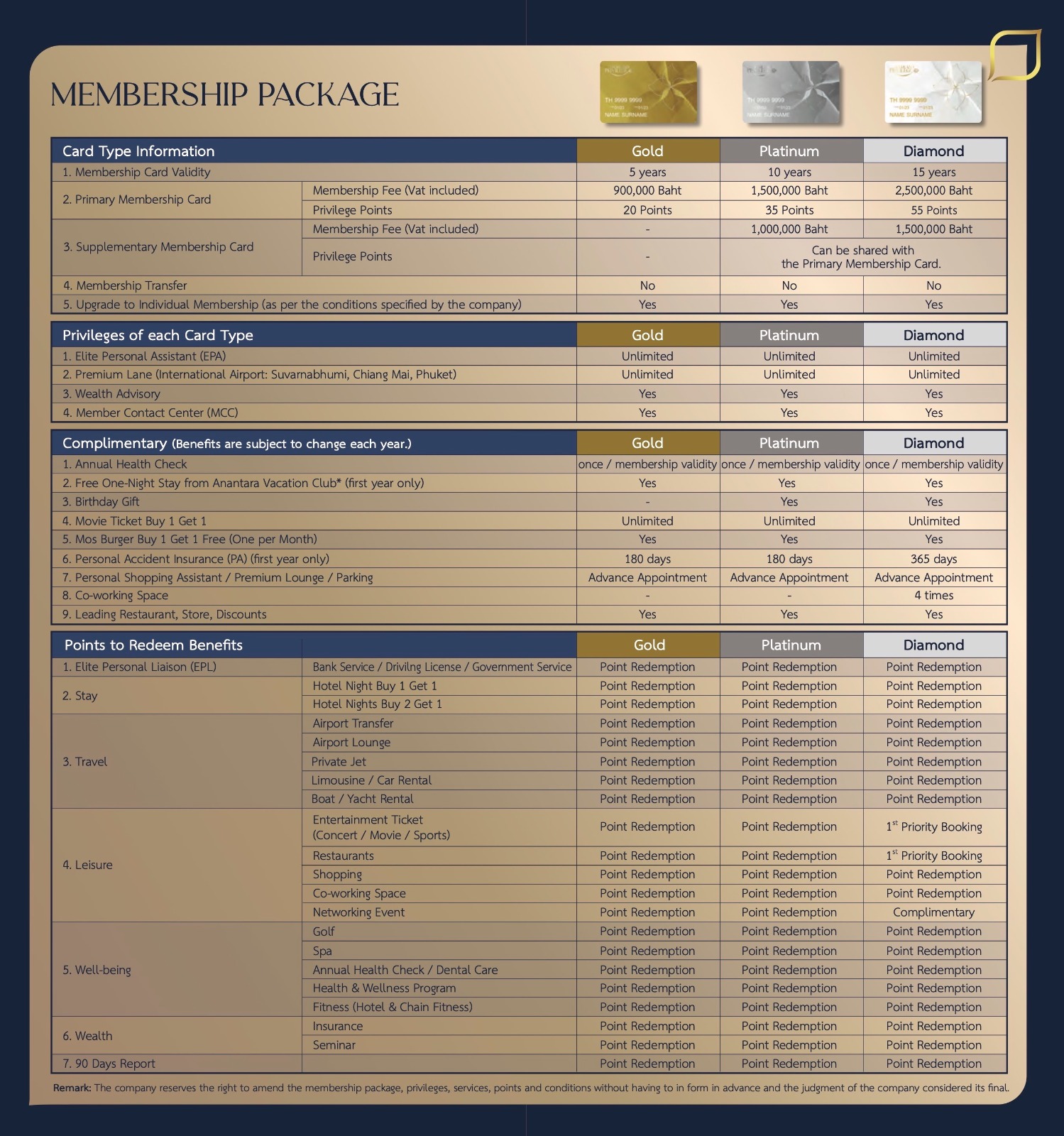

Please consult the chart below for a quick comparison between that of the cheapest entry level “Gold” membership option which starts at just 900,000THB for an individual 5 Year Visa and that of the most expensive creme de la creme “Diamond” membership option which costs 2,500,000THB for an individual 15 Year Visa (yes, you read this correctly) with a whole list of extra value added “VIP” perks and benefits (which do vary in accordance with your membership choice), together with a brief overview of each and every other “Thailand Privilege Card” membership option in between:

And if this wasn’t impressive enough the “Thailand Privilege” membership options offer an impressive array of additional perks, VIP privileges, and benefits such as:

- “No Annual Membership Fees” apart from the initial upfront payment (which varies according to your choice of membership option i.e. “Gold”, “Platinum” or “Diamond”.

- Unlimited access to an “Elite Personal Assistant” (EPA) who will meet and greet you upon arrival and departure to and from Thailand.

- Unlimited “Premium Lane” access at participating International Airports (Suvarnabhumi, Chiang Mai & Phuket) to fast track you through Thai Immigration & Passport Control.………helping you to jump the queue and to save valuable time.

- Unlimited access to “Buy 1 Get 1” Movie Tickets at participating venues.

- Access to an “Elite Personal Liaison” (EPL) assistant for “Bank”, “Driving License” and “Government” related services via a “Privilege Point” redemption scheme.

- Access to “Special Promo Offers / Discounts” such as “Buy 1 Get 1 Free” offers at participating venues such as “Mos Burger” (terms and conditions apply).

- Access to “Buy 1 Get 1 Free” / “Buy 2 Get 1 Free” Nights at participating hotels via a “Privilege Point” redemption scheme.

- Similarly, access to “Airport Transfers”, “Airport Lounges”, “Private Jets”, Limousine / Car Rental Services” and “Yacht / Boat Rental Services” again using the“Privilege Point” redemption scheme.

- Access to “Movie Tickets”, “Restaurants”, “Co-working Spaces”, “Shopping” and “Networking Events” at participating venues via a “Privilege Point” redemption scheme.

- Access to “Golf Courses”, “Health Spa Services”, “Annual Health Check / Dental Care” and “Fitness Centers” at participating venues via a “Privilege Point” redemption scheme.

- Access to “Insurance” and “Wealth Management Seminars” at participating venues via a “Privilege Point” redemption scheme.

- Access to a “90 Day Reporting Service” again using the “Privilege Point” redemption scheme.

So, how does one apply for “Thailand Privilege” membership?

For added convenience, you can easily apply for “Thailand Privilege Card” membership from both overseas (like most other Visas) or from Thailand, by simply contacting My Pattaya Condo and we’ll refer you onto a participating “Thailand Privilege Card” Visa specialist.

The only precursor apart from the paying the prescribed rate (depending on your choice of membership class) and filling in an application form is that you must pass a criminal background check beforehand, whereupon you’ll either be issued with a “Thailand Privilege” Visa on arrival or if you’re already in Thailand at the time of applying for a “Thailand Privilege” Visa (existing Visa permitting) you can pick up your “Thailand Privilege” Visa from the main Immigration Bureau in Bangkok.

For more information Please fill the form.

“Long Term Resident” (LTR) Visa – (10 Years Renewable)

For starters, this type of “Visa” which is valid for 10 Years doesn’t grant the applicant (if approved) with any form of “residency or naturalization status”, as the inclusion of the word “Resident” in the visas description is somewhat of a misnomer.

If you’re fortunate enough to be either a wealthy and/or skilled professional individual who wishes to live, work, invest and conduct business in Thailand with relative ease on a more longer term basis you may be eligible to qualify for a LTR Visa if you fall within the following 4 categories:

- Wealthy Global Citizens: Personal assets exceed $1 Million USD or $80,000 USD per annum in personal income or $500,000 USD invested in either Thai Government Bonds/Direct foreign investment/Thai Property

- Wealthy Pensioners: $80,000 USD in personal income per annum or $40,000 USD (min) in personal income per annum + $250,000 USD (min) in either Thai Government Bonds/Direct foreign investment/Thai Property.

- Foreign Remote Workers: $80,000 USD per annum in personal income or $40,000 USD (min) per annum in personal income + Master’s Degree (or higher) or Intellectual Property Rights or Series A Funding. Foreigners must have 5 Years (min) relevant work experience and work for an overseas based foreign public or private company with a combined revenue of $150 Million USD or more over the last 3 Years.

- Foreign Highly-Skilled Professionals: $40,000 USD* (min) per annum in personal income (over the last 2 Years) + Master’s Degree (or higher) in Science or Technology or Specialized Expertise unique to the job assignment in Thailand. *Special (min) annual USD income per annum exclusion when working for an official Thai government agency. Foreigners must have 5 Years** (min) relevant work experience and conduct business in either a Specific Targeted Industry or Research/Tertiary Education Institution or Thai Government Agency. **Special 5 Year (min) work experience exclusion for PHD Degree (or higher).

Irrespective of category each eligible applicant must have $50,000 USD (min) in Mandatory Health Insurance coverage or be Self Insured with $100,000 USD (min) in a Thai bank account.

Successful LTR Visa applicants (if approved) receive the following benefits:

- 10 Year Renewable Visa – No annual renewals, less hassle and less bureaucratic red tape.

- Digital Work Permit – You can legally work in Thailand.

- No 4:1 Thai/Foreigner Employment Ratio Requirement – You’re exempted from having to employ a minimum of 4 Thai persons to qualify for Thai work permit approval.

- Tax Benefits – 17% Personal Income Tax rate.

- Fast Pass – Priority Immigration access at participating Thai International Airports.

- No 90 Day Reporting Requirement – Only 1 time per Year.

- No Re-entry Permit Requirement – You’re exempted from having to apply for a “single” or “multiple” re-entry permit each time you depart and re-enter Thailand.

- Foreign Dependents – Your spouse and children (under 20 Years) are eligible for LTR Visa status (maximum of 4 dependents).